AnnArborSD

-

Content Count

6 -

Joined

-

Last visited

Content Type

Profiles

Forums

Articles

Store

Posts posted by AnnArborSD

-

-

2 minutes ago, MattR said:

Could be that you don't have to fill out taxes but the rest of it's correct.

Who is your CO? Assuming it's a church and that church has a kids group, would you expect them to have their own EIN number? That's the exact situation your troop is in. Unless you don't have a CO, use the CO's EIN number.

Our Troop is chartered by "Friends of... so-and-so" and NOT a non-profit nor does our C.O. have their own EIN. This I confirmed. So I cannot use the Tax ID or EIN for our C.O.

-

1

1

-

-

17 hours ago, MattR said:

You should be using your Chartered Organization's EIN number, as your troop is likely not it's own entity. It is also not part of the BSA. It is part of the CO and that's why you use their number. If you create your own EIN number then you'll have to fill out taxes every year as well. And get your own insurance....

I just learned (see my post above) that this is not true -if- when someone requests their EIN, they choose the "Community or Volunteer Group" designation, a person/entity does not necessarily have to fill out taxes every year. Or, at least, that's what the nice IRS Operator advised me (IRS Operator ID #1000270440) when I called today. Thanks!

-

Thanks to everyone for your comments and assistance. Wow, what a great community! So, a follow-up for anybody following along at home or to help someone else searching forums in the future looking for help...

I called IRS again today, 12/04/2018 (at 800-829-4933) as I wanted to try another tactic. My goal was to communicate that I did not check "non-profit" organization on my EIN application and I did choose 'Community or Volunteer Group' category and have my EIN Record changed. @DuctTape had a great point...I think the main problem here is that I put "Boy Scouts of America...." on my application. I should have just put our "Friends of ..." C.O. there.

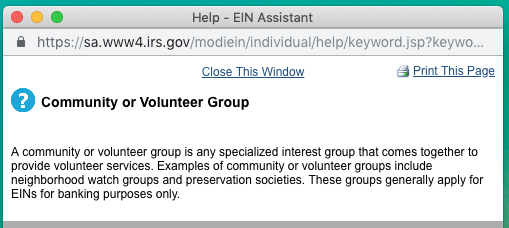

Anyway, the IRS person agreed that "Community or Volunteer Group" is the right category but here's the a-ha moment: she advised me that anytime ‘Community or Volunteer Group’ is used, it is always categorized as non-profit on the EIN. The ‘Community or Volunteer Group’ is defined as:

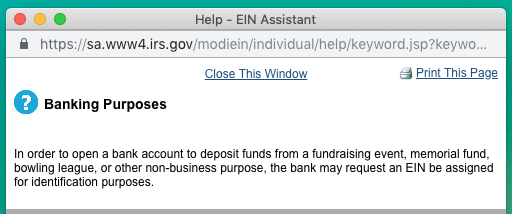

And Banking Purposes is defined as:

I asked if someone who has a bank account for a bowling league (for example) and needs an EIN would IRS agree that the bowling league coordinator most certainly is not filing 501(c)(3) nor likely doing anything with Form 990 for tax purposes, etc. So would there be any penalty or problem if I just ignore all things related to Form 990, non-profit, etc? IRS agreed! In fact, they advised that my EIN looks fine as it doesn't show any filing requirement on record. But, the IRS person did advise I call back in June or July 2019 to again verify that the EIN doesn't have any filing requirement still on record.

So, I think I'm good. Thanks again for all your help!

-

1

1

-

-

3 minutes ago, Jahaza said:

It sounds like your chartered organization needs to sort out their legal status before you can sort out yours.

Thanks for the note! But nothing will change on that front. Our C.O. as I understand it is a bunch of long ago (but still active) parents who joined together to support and charter the Troop back when schools stopped being direct charting organizations. I've talked to our C.O.R. (Chartering Organization Representative) about this and they have no intention of getting their own EIN. They have no bank account nor have they any financial activity whatsoever.

-

Hi. I am the new treasurer of a BSA Scout Troop in Ann Arbor, Michigan (hi everyone!) and looking for some advice on obtaining an EIN for bank account purposes. It's proved challenging and am hoping someone has pointers for me especially if someone has gone thru this type of situation before. My goals are: a). to obtain an EIN, and b). avoid having to do annual tax paperwork (we've never done it) but willing to if it's easy and required, and c) above all, follow the law and BSA guidance appropriately.

Here's my story...

- Our Troop has had their checking account since 1998. We don't keep much money in the account; a few thousand $ at most and it's also in a non-interest bearing account.

- Recently, when we added my name to the bank account, the bank advised us we needed an EIN (Employee Identification Number) for the bank account and showed surprise that our account has existed at all without an EIN due to the Patriot Act. I've confirmed from BSA from the "FISCAL POLICIES AND PROCEDURES FOR BSA UNITS" document (dated August 2013) that indeed each Troop/Pack/Unit should have an EIN.

- Our Troop is chartered by "Friends of... so-and-so" and NOT a non-profit nor does our C.O. have their own EIN. This I confirmed. So I cannot use the Tax ID or EIN for our C.O.

- I then go the route of getting my own EIN for the Troop by applying online for SS-4 at https://sa.www4.irs.gov/modiein/individual/index.jsp but I keep getting rejected with a reference code of 101 online. For reference, I selected type as 'Community or Volunteer Group' since "these groups generally need an EIN for banking purposes" for "fundraising event, memorial fund, bowling league, or other non-business purpose". But I keep getting the online rejection of reference code 101.

- Now I call IRS at 800-829-4933 about the reference code 101. I connect with an agent who advises me she doesn't know why I'm receiving the rejection code 101, but advises I should complete the SS-4 Form manually and send via fax. I do this.

- About 3 weeks later I receive a letter from IRS advising me I have an EIN. Yay! But they tell me in my letter, "When you submitted your application for an EIN, you checked the box indicating you were non-profit organization" and then goes on to tell me about non-profit forms 990, 990-EZ, etc. I verify my application and I most certainly did not check any box indicating I am a non-profit organization. I clearly advise "Community or Volunteer Group" only and is needed only for banking purposes.

- So I call IRS again and am told that Boy Scouts of America is non-profit so I should be all set and I should be happy. I was literally told this! I argue that the downstream units (my Troop) are not covered under the BSA charter nor Group Exemption and I stress again that all I need is an EIN for our bank account and that I'm NOT non-profit. To be clear, we're not for-profit, but we certainly aren't recognized as non-profit via 501(c)(3) formalities. I am told again that Boy Scouts of America is non-profit so I should be all set. I press again and am advised I should write IRS a letter explaining my situation.

Before I write a letter to IRS, I figured I would check here on the forum... Any ideas or suggestions? Has anyone else successfully received an EIN for a Troop/Pack/Unit from the IRS? Any clue what you may have entered in your fields to successfully get your EIN and not have IRS think you were non-profit? Any ideas I can tell IRS if I call them again to let me keep my EIN (or give me a new one) by reclassify me NOT as non-profit? I was thinking that since I received the EIN from IRS maybe I should just run with what I have, but the fact that they think I am non-profit and I don't really plan to do Form 990, etc, that seems misleading and a very bad idea.

Any guidance or help greatly appreciated!

EIN Assistance - bank account needs

in Open Discussion - Program

Posted

@T2Eagle Understood. Yes, not knowing what I was doing the first round here, I did put it in as "BSA Troop xx" and not our CO name. I will ask IRS to correct that, but you're right it solved the practical matter.

The larger issue here, .our C.O. is not very engaged on such matters. As I understand our Troop history, a bunch of parents got together to create the "Friends of ..." organization to be the C.O. because the School District at the time dropped being the C.O due to inclusivity disagreements between BSA National policies and school policies. This was over 10 years ago and well, well, well before my time. But there are parents today part of the original C.O.formation still involved, but it's very casual arrangement. Frankly, more casual than I would prefer, but it is what it is. I've poked around, asked questions about a more formal C.O. relationship, but it ain't happening any time soon.

For the record, we have an absolutely wonderful Troop, Committee and involvement from our C.O.R when needed. Parents and boys are happy, so I'm not about to go muck things up.